Audit Services for Businesses in UAE

Accurate. Transparent. Compliant.

When it comes to your business finances, there’s no room for guesswork. At Interpath Consulting, we provide end-to-end legal and financial audit services that not only keep your business compliant with UAE regulations but also uncover insights that help you grow.

As one of the trusted audit firms in Dubai, we combine deep financial expertise with a clear understanding of UAE’s complex legal framework. Whether you’re a local business or an international company operating in the Emirates, our audit solutions ensure accuracy, transparency, and peace of mind.

Why Your Business Needs Legal & Financial Audits in the UAE

In today’s business environment, audits aren’t just a legal requirement—they’re a strategic advantage. They:

Confirm the accuracy of your financial statements.

Ensure compliance with UAE laws and international standards.

Identify inefficiencies and risks before they become costly problems.

Build investor and stakeholder confidence.

Support informed decision-making for growth.

Without the right audit partner, even the most successful companies risk financial missteps and legal penalties.

Our Legal & Financial Audit Services

We offer a comprehensive audit and compliance portfolio designed to protect your business, meet regulatory standards, and enhance financial performance.

1. Statutory Audits

Mandatory for many UAE businesses, our statutory audits ensure your financial reporting aligns with local laws and International Financial Reporting Standards (IFRS).

2. Internal Audits

We review your internal controls, processes, and systems to identify weaknesses, prevent fraud, and improve operational efficiency.

3. Compliance Audits

We verify that your operations meet UAE’s legal requirements, tax regulations, and licensing obligations—reducing your risk of penalties.

4. Legal Due Diligence

Before mergers, acquisitions, or partnerships, we conduct thorough legal and financial due diligence to protect your interests.

5. Risk & Fraud Detection

Our experts identify and assess potential risks—financial, operational, and legal—so you can take preventive action.

6. Tax Compliance Review

We ensure your business adheres to UAE VAT laws and other tax regulations while optimizing tax efficiency.

Why Choose Interpath Consulting?

Recognized Expertise – Trusted among top accounting firms in Dubai for delivering precise, actionable audit reports.

Local + International Insight – UAE-specific compliance knowledge, backed by global audit standards.

Tailored Solutions – We adapt our audit approach to your industry and business size.

Confidentiality Guaranteed – Your data and documents remain secure at every stage.

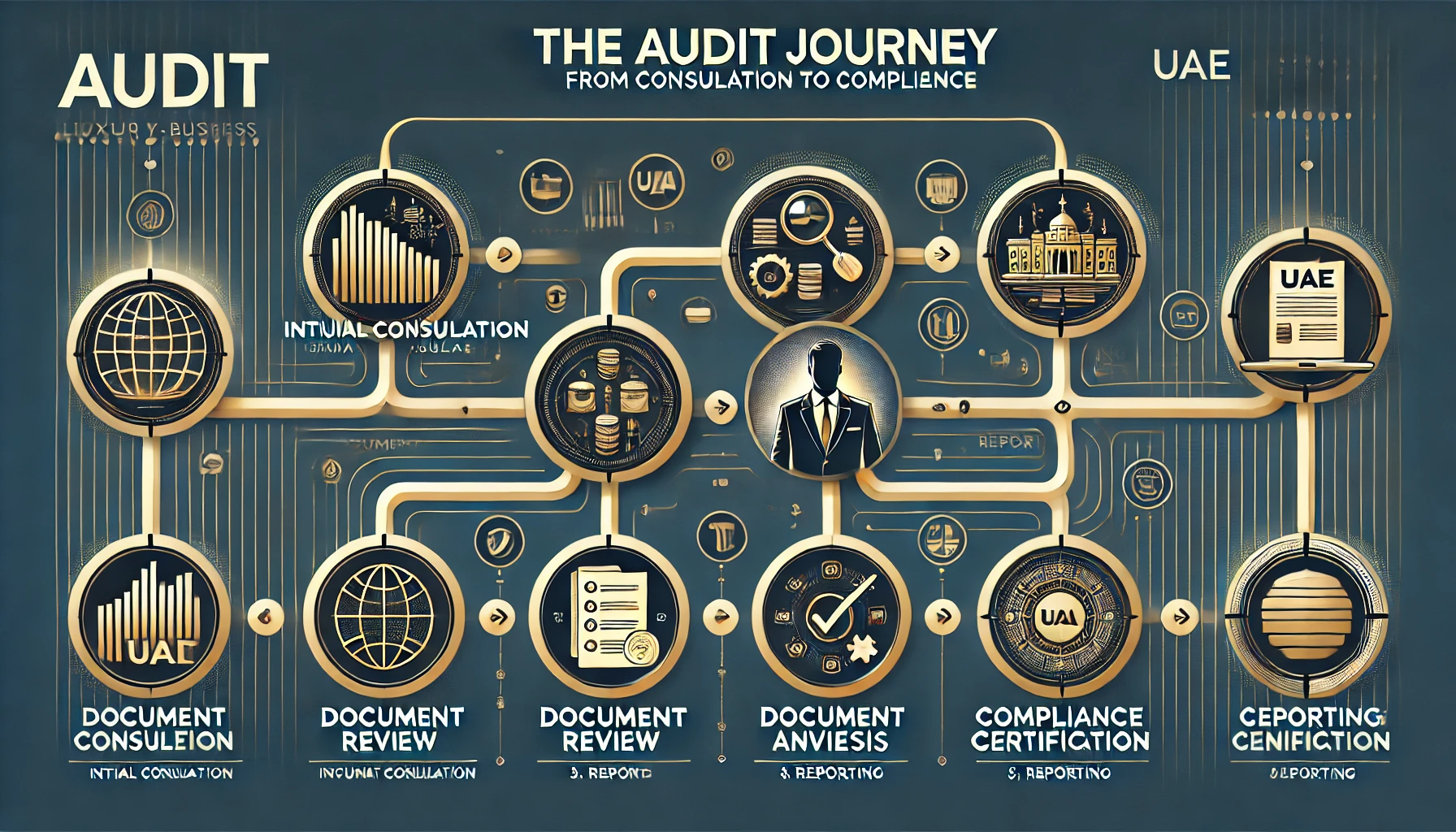

Our Audit Process – Simple & Transparent

Consultation – We understand your business needs and audit objectives.

Data Collection – Securely gather all necessary financial and legal records.

Detailed Audit Review – Conduct financial analysis, compliance checks, and legal verification.

Reporting & Recommendations – Deliver clear reports with actionable insights.

Ongoing Support – Assist with implementing improvements post-audit.

- Are financial audits mandatory in the UAE?

-

Yes. Many UAE companies, depending on their legal structure, must submit audited financial statements to maintain compliance and renew trade licenses.

- How long does an audit take?

-

A standard financial audit typically takes 2–4 weeks, depending on the size and complexity of the business.

- Do you work with small businesses as well?

-

Absolutely. We tailor our audit services for startups, SMEs, and large corporations.

- Can you help with both legal and financial compliance?

-

Yes. Our team covers both financial reporting accuracy and legal requirements, making us a complete compliance partner.

- How do you ensure confidentiality?

-

We use secure systems and strict internal protocols to protect all client data and documentation.